Single Moms Can Now Invest In Their Own House – Just Follow These Easy Tips

en etweBeing a single mom is not easy; there’s no doubt about that. Raising children is a challenge in itself, and raising them alone doubles the pressure instantly. How do you provide the best for your child on just one paycheck? On top of that, how do you fulfill other necessities of life, all while enduring full responsibility for your child?

One of the biggest things single moms dream about is having a home to raise their kids in. Between buying and renting, buying is definitely the cheaper option in the long-term.

As a single parent, you probably also struggle with money and budgeting. As such, credit card scores might not look so great, making it even harder for you to get your mortgage approved. Fortunately, there are many ways you can save money and reposition your finances to be able to get your mortgage approved quickly.

These three tips have helped single moms in saving money and getting their mortgage on time.

1. Don’t Delay Your Loan Payments

A quick extra tip: pay off all loans with the highest interest rate first and foremost. Even though this might seem quite obvious, most people don’t deem it necessary. The reason why these loans have to be paid off as soon as possible is that they are costing you more money. The more you delay your payments, the higher the benefit for the lender. You could also opt to pay the minimum requirement suggested. In this way, you won’t be viable to pay the interest and won’t have a bad credit score, either.

Many experts also advocate for the following method in case you have multiple loans to pay off. They recommend that you choose one loan to focus on and prioritize paying it off. Once you are successful in unburdening yourself of that loan, you can move on to the next one.

Unsplash | Learn how to pay off your loans smartly

2. Budget Your Monthly Expenses

Unconscious and unplanned spending is the best way to dig through your earnings as quickly as possible. No one wants that, right? We can’t stress enough how much easier budgeting will make your life. First of all, you must make a detailed plan for the expenses you have every month. After making the plan, if you’re spending more money and saving close to none, you might want to readjust your lifestyle a bit.

If you have trouble making these plans the traditional way, you can always look for software or apps that can help you out. Creating a monthly budget will organize your finances and motivate you to achieve your goals quicker.

Unsplash | Every smart financial decision will bring you one step closer to your dream house

3. Set Financial Goals

Sure, budgeting will help motivate you to achieve your goals in a short amount of time but, for that, you need to have goals first. As a single mom, planning and setting goals can be the best gift that you give your child. And no, you shouldn’t be taking more loans to achieve your goals.

You might want to reassess your financial situation if your goals seem too farfetched. Ask yourself if you need to land a better paying job, how much monthly payments you’d have to make on your mortgage, and how much you’d like to spend on your child’s education.

More in Criminal Attorney

-

A Step-By-Step Guide to Becoming a Real Estate Lawyer

A real estate lawyer specializes in legal matters related to property, from transactions to disputes. They ensure legality in real estate...

December 3, 2023 -

What Is Asylum & How Does It Work?

At its core, asylum is a protection granted to foreign nationals in a country because they have suffered persecution or have...

November 26, 2023 -

6 Reasons Why Sentencing Is Any Judge’s Toughest Assignment

When you picture a judge, you might imagine a stern figure in black robes, gavel in hand, delivering verdicts with unwavering...

November 14, 2023 -

Carrie Underwood Sued for NBC Sunday Night Football’s “Game On”

It is almost ritualistic. As the weekend winds down and Sunday evening approaches, millions across America gear up for a night...

November 12, 2023 -

Why Lawyers’ Productivity Has Increased in Modern Times

Remember the old days when your image of a lawyer might have been drawn straight out of an episode of “Matlock”...

November 5, 2023 -

Paying Down Debts Using Debt Relief Tactics

Debt is like that lingering headache that never seems to go away, no matter how much aspirin you pop. But there...

October 29, 2023 -

Pro Se: Your Right to Represent Yourself WITHOUT an Attorney

The legal system is complex and so, more often than not, people hire a professional attorney to navigate the legal system....

October 21, 2023 -

The Craziest, Most Expensive Hollywood Divorces of All Time

Hollywood is the land of glitz, glamour, and romance – until it is not. Over the years, we have seen our...

October 13, 2023 -

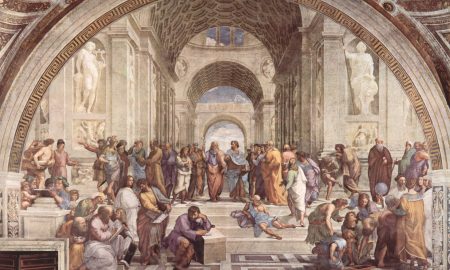

How Was Life as a Lawyer in Ancient Rome?

The Late Roman Republic was a period chock-full of political drama, rampant corruption, and the rise and fall of powerful figures....

October 8, 2023