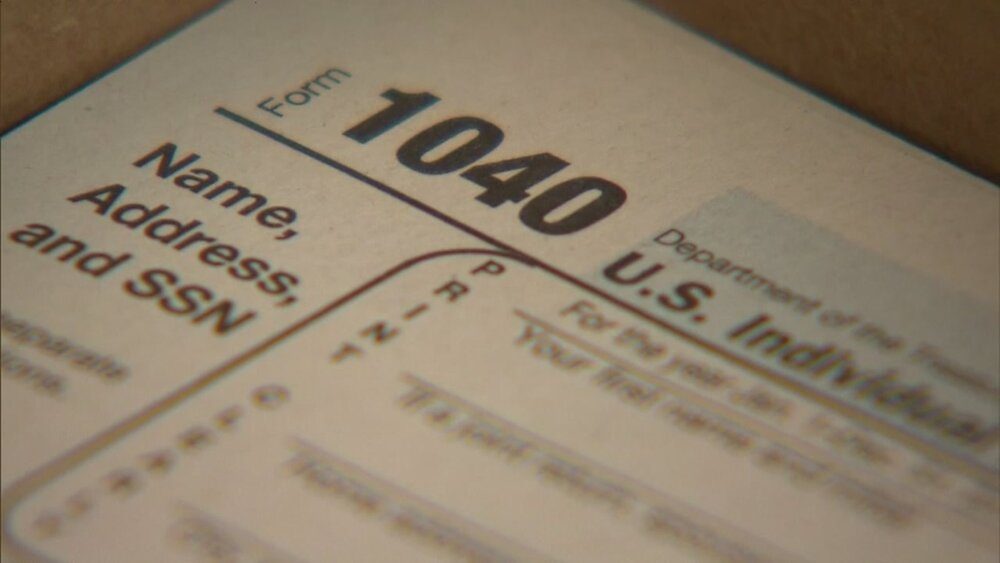

101 Guide For First Time Tax Filers

Doing anything for the first time can be intimidating, and it’s especially true when it comes to important financial actions like filing taxes.

Vonder Haar Law | If you’re filing taxes for the first time, it might get a little overwhelming

Filing taxes at the beginner’s level could be a major achievement for any young grown-up. You might have taken your parents or experienced family members’ help earlier, but when it’s your turn to take responsibility for your funds and file your return, you might easily get the jitters. Even so, it only takes a little practice to master the act, and if you follow the handy pieces of advice given below, you can go through the procedure smoothly every single time.

Read – How to claim missing Stimulus money on your 2020 Tax Return

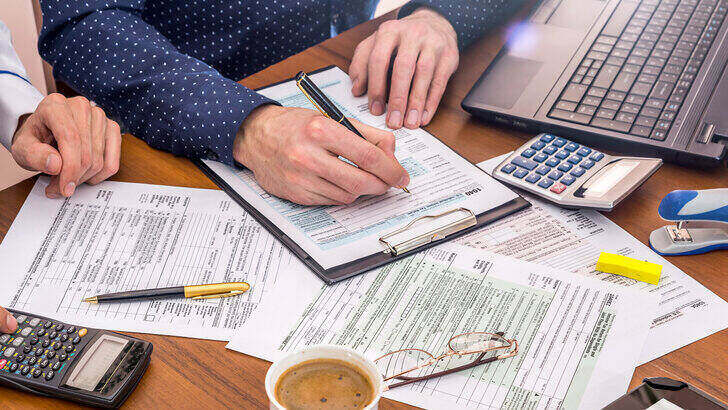

Collect all your documents

Before you start, you need to ensure you have your:

- Tax documents that include other kinds of income,

- 1099s,

- W-2s,

- Tax receipts, and

- Deductions

Read – IRS First-Time Penalty Abatement

Remember your previous actions

Consider everything you did in the last year that may affect your taxes, including:

- Opening another savings account

- Changing job

- Selling mutual funds or stocks

- Paying student loan interest or college tuition fee

File taxes electronically

From settling your bills to ordering dinner online, you can do almost everything from the comfort of your home these days. So why not file taxes online too? E-tax filing saves your time. All you need to do is fill out the correct forms, upload a few documents, and click a few buttons. It saves you a lot of time and eliminates the need to stand in queues or struggle with postage.

CBC | E-tax filing can save you from a lot of manual effort

Don’t forget your alternate sources of income

A large number of youngsters earn from the “gig economy” by freelancing part-time. From being rideshare drivers to making food deliveries or working as a project manager – your gig could be anything. But if you’ve earned money from any such side hustle, remember to report your revenues while filing your taxes.

Consider tax credits and deductions

Tax credits and deductions can decrease your total tax bill and even expand your ITR, so always ensure that you take full advantage of everything you’re qualified to claim. A few basic deductions for first-time tax filers are:

- Itemized deduction or standard deductions

- Education credits including the Lifetime Learning Credit and the American Opportunity Credit

- Acquired Income Tax Credit

- Student loan interest allowance

- Home office allowance, if you’re self-employed

Choose whether your folks can still claim you as a dependent

Many youngsters get financial help from their folks, even after they’ve begun making money. You may be getting funds from them to bear with living expenditures, or they might be paying your education expenses. If this is the case, your folks may still claim you as a dependent on their ITR.

Live Strong | If your parents are contributing to your living and education expenses, they may still claim you as a dependent on their ITR

Summing up

Since you’re headed towards tax filing for the very first time, it might feel a little overwhelming. But trust us, it’ll get simple. We truly hope that the above-mentioned tips would help you and reap benefits.

More in Legal Advice

-

A Step-By-Step Guide to Becoming a Real Estate Lawyer

A real estate lawyer specializes in legal matters related to property, from transactions to disputes. They ensure legality in real estate...

December 3, 2023 -

What Is Asylum & How Does It Work?

At its core, asylum is a protection granted to foreign nationals in a country because they have suffered persecution or have...

November 26, 2023 -

6 Reasons Why Sentencing Is Any Judge’s Toughest Assignment

When you picture a judge, you might imagine a stern figure in black robes, gavel in hand, delivering verdicts with unwavering...

November 14, 2023 -

Carrie Underwood Sued for NBC Sunday Night Football’s “Game On”

It is almost ritualistic. As the weekend winds down and Sunday evening approaches, millions across America gear up for a night...

November 12, 2023 -

Why Lawyers’ Productivity Has Increased in Modern Times

Remember the old days when your image of a lawyer might have been drawn straight out of an episode of “Matlock”...

November 5, 2023 -

Paying Down Debts Using Debt Relief Tactics

Debt is like that lingering headache that never seems to go away, no matter how much aspirin you pop. But there...

October 29, 2023 -

Pro Se: Your Right to Represent Yourself WITHOUT an Attorney

The legal system is complex and so, more often than not, people hire a professional attorney to navigate the legal system....

October 21, 2023 -

The Craziest, Most Expensive Hollywood Divorces of All Time

Hollywood is the land of glitz, glamour, and romance – until it is not. Over the years, we have seen our...

October 13, 2023 -

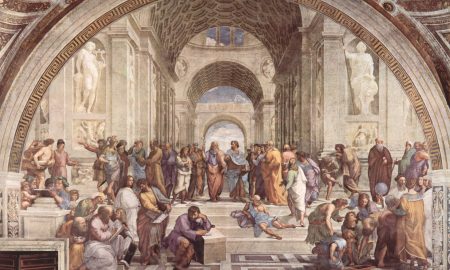

How Was Life as a Lawyer in Ancient Rome?

The Late Roman Republic was a period chock-full of political drama, rampant corruption, and the rise and fall of powerful figures....

October 8, 2023